Credit Default

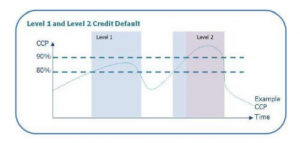

The Credit Default processes are triggered when a Party’s Credit Cover Percentage (CCP) exceeds a number of thresholds. The Level 1 Credit Default process is triggered when the CCP exceeds 80% and the Level 2 Credit Default process is triggered when the CCP exceeds 90%. The Party must reduce the Credit Cover percentage below 80% by the end of the query period to resolve the Credit Default

On this page

How it relates to you

At any given time, Trading Parties may have accrued Trading Charges which have not yet been paid. Credit checking arrangements ensure that, should a Trading Party become unable to pay the Trading Charges, sufficient collateral is available to cover the charges.

The Credit Cover Percentage (CCP) is determined by comparing the Trading Party’s Energy Indebtedness with the amount of Credit Cover in place.

The Credit Default processes are triggered when a Party’s Credit Cover Percentage (CCP) exceeds a number of thresholds. There are two Credit Default thresholds:

- Level 1 Credit Default process is triggered when the CCP exceeds 80%

- Level 2 Credit Default process is triggered when the CCP exceeds 90%

BSC documentation

Section H of the BSC sets out the rules relating to default under the BSC and includes details of how a BSC Party can become a Defaulting Party.

Although the general defaulting provisions are much wider than just Credit Default, Section H does cover instances where prolonged Credit Default can result in a BSC Party becoming a Defaulting Party.

If a Party fails to resolve a Credit Default situation the Party will potentially be in default of the Balancing and Settlement Code Section H3.1.1.

Further reading

- Guidance Note on Credit Default

- Guidance Note on Defaulting Party and Failing Supplier Process (Section H)

Monitoring Credit Cover Percentage

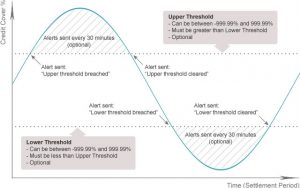

Email alerts for Credit Cover Percentage (CCP) can be setup on the Elexon Portal. This service will notify you when your CCP exceeds or falls below a certain percentage. In addition to this, you can also choose to receive an email update every half hour

The diagram below explains the process of the alerting service.

To activate your alerts, please visit the Credit Cover History/Alerting section of the Elexon Portal.

Please note that your account will need to be linked to your Party ID to have permission to access Credit information.

If your profile is not linked to your BSC Party ID, follow the steps below:

- Go to ‘My Profile’

- Click on the ‘Organisations’ tab

- Enter your Participant ID and click on ‘Request Participant’

Once approved, you will have access to your Party’s information. If you do not have access to the Credit information for your Party:

- Go to ‘My Profile’

- Click on the ‘Permissions’ tab

- Tick the ‘Credit’ box

Once approved, you will be able to access Credit information for your Party.

Entering the Query Period

At the Settlement Period the CCP becomes greater than 80%, your Party will enter a Query Period. At this point you will be informed that your CCP has exceeded 80%.

The Query Period is a minimum of 24 hours in duration where your Party will take any actions necessary to remedy the Credit breach.

It also during this period where your Party may submit evidence if you believe the CCP to be incorrect and not reflective of your true indebtedness position.

During the Query Period, there is no action taken against your Party and it must contain five consecutive Business Hours, where Business Hours are 09.00 to 17.00 on a Business Day.

To exit the Credit Default process when in the Query Period, the CCP must be less than 80% at the end time of the Query Period.

To ensure that you can be contacted immediately if a breach occurs, please provide ELEXON with a 24 hour contact. During the Query Period you may query the determination of your CCP.

Any queries should be raised via the Elexon Support or through your Operational Support Manager.

Entering the Default Cure Period

If, at the end of the Query Period, any investigation has determined that the CCP for the given Settlement Period was definitely greater than 80% you will enter a Default Cure Period.

This means you must ensure that your CCP is reduced to less than 75% for at least one Settlement Period before the end of the next Business Day.

You can reduce your CCP by increasing collateral or by purchasing (and having notified to the ECVAA) contracts for additional energy and hence reducing your indebtedness.

While additional collateral may only be posted during Funds Administration Agent (FAA) Business Hours, Energy Indebtedness can be reduced at any time.

However, reducing Energy Indebtedness will involve taking a ‘long position’ in one or more Settlement Periods, during which time you will be exposed to the System Price.

Entering Level 1 Credit Default

If you fail to reduce your CCP by the end of the Default Cure Period, then you will be in Level 1 Credit Default.

The consequences of Level 1 Credit Default are that a notice is published on the Balancing Mechanism Reporting Service (BMRS) website, and ELEXON issues an authorisation notice to the ECVAA that permits the rejection and refusal of notifications if your CCP subsequently becomes greater than 90%.

You will no longer be in Level 1 Credit Default when your CCP becomes less than 75%. At this point, the notice will be end-dated on the BMRS website and the authorisation notice withdrawn.

The BMRS website notice will be removed after seven calendar days.

Entering Level 2 Credit Default

The Level 2 Credit Default process is initiated if your CCP becomes greater than 90%.

The Query Period still applies but there is no Default Cure Period relating to Level 2 Credit Default.

The consequences of Level 2 Credit Default are that a notice is published on the BMRS website, and Volume Notifications will be refused and/or rejected as follows:

- any Energy Contract Volumes Notifications (ECVNs) or Metered Volume Reallocation Notifications (MVRNs) that are submitted and which would increase (or not decrease) Energy Indebtedness at any point in the future will be refused

- any Energy Contract Volumes or Metered Volume Reallocations that have been previously notified and which increase Energy Indebtedness for the upcoming Settlement Period will be rejected on a Settlement Period by Settlement Period basis, and the counter-parties to the notification are informed by the ECVAA

Energy Contract Volumes and Metered Volume Reallocations that increase Energy Indebtedness are those which represent the sale of energy by one Trading Party to another Trading Party, and make the first Trading Party’s Account Energy Imbalance Volume shorter.

As future Systems are unpredictable there is no way of knowing whether new ECVNs or MVRNs containing both sales and purchases will, overall, increase or decrease financial indebtedness.

Therefore if an ECVN or MVRN represents the sale of energy in any Settlement Period, it is refused.

For previously notified ECVNs and MVRNs, the Energy Contract Volumes or Metered Volume Reallocations are rejected one Settlement Period at a time.

However, rather than reject these for the Settlement Period for which the Submission Deadline has just elapsed, they are rejected for three Settlement Periods later.

This gives the counter-party, who will otherwise be left short by the cancellation of a Volume Allocation in their favour, a limited time in which to re-contract with a different, non-defaulting Trading Party.

You will no longer be in Level 2 Credit Default when your CCP becomes less than 90%.

At this point, the notice will be end-dated on the BMRS website and contracts will no longer be restricted.

The BMRS website notice will be removed after seven calendar days.

Frequent Credit Default

A BSC Party in Credit Default can also in the following circumstances, become a Defaulting Party under Section H of the BSC if that Party:

- has three Credit Defaults Authorised (i.e. published to BMRS) in a period of six months

- has been in Level 2 Credit Default with a Credit Cover Percentage greater than 100% for more than two working days, and where the Credit Cover Percentage was not equal to or lower than 90% by the end of the same numbered Settlement Period two working days after the percentage exceeded 100%

- has been in Level 2 Credit Default for 60 continuous days or an intermittent period of 75 days out of 120

- has been in Level 1 Credit Default for 90 continuous days or an intermittent period of 120 days out of 180

Where a BSC Party becomes a Defaulting Party as a result of one of the above Credit Default scenarios, the BSC Panel may take a number of steps including withdrawing the right to be party to any notifications, potentially de-energisation and expulsion from the BSC.